i-bfp KYC Solutions

i-bfp stands for India Bank Fraud Prevention.

The objectives of KYC guidelines is to prevent banks from being used, intentionally or unintentionallyby criminal and fraudulent elements and avoid defaulting fromBank Home loan, Education loan, Personal loan, Vehicle Loan, Business loan, frauds and money laundering activities. Related procedures also enable banks to better understand their customers and their financial dealings. This helps them manage their risks prudently. The Reserve Bank of India introduced KYC guidelines for all banks in 2002. In 2004, RBI directed all banks to ensure that they are fully compliant with the KYC provisions before December 31, 2005.

The Indian banking sector is experiencing a plethora of changes as it gears up to meet international standards, while balancing its commitment to financial inclusion. The last two years have been particularly significant from a fraud risk management perspective, with the RBI issuing several directives aimed at improving governance and profitability levels among banks, by mitigating the risk of loan defaults and fraud.

The pace of change in the sector has left banks grappling with multiple fraud-related challenges. On the one hand financial crime appears to be a major concern for banks as the number of incidents and value of fraud rise, on the other hand there appears to be a certain lag in the implementation of fraud risk management measures mainly because of shortage of manpower and necessary skills. With the current economic slowdown and increased use of technology, incidents of fraud are also expected to increase further. Continued reliance on manual controls to detect red flags and well known frauds such as diversion of funds and fraudulent documentation leading to loan fraud continue to impact the sector more significantly than cyber-crime which is dominating the Indian banking fraud landscape.

As per the Indian Banking Fraud Survey 2015 conducted by Deloitte, retail banking has been identified as the major contributor to fraud, followed by corporate banking. The survey identifies, Fraudulent Documentation, Over Valuation / Non – Existent Collateral and Identity Theft are major causes of fraud in retail banking. In the corporate banking segment, Diversion of Funds, Siphoning of Funds, Incorrect Financial Statements, Fraudulent Documentation and Over Valuation / Non – Existent Collateral are major causes.

Retail banking is considered relatively more process-oriented, requiring significant control and meticulousness over the due diligence carried out while on-boarding a customer. Given the limited resources banks have to monitor these processes and adequately verify documents/ information, and the increasingly fragmented nature of customer information available, the risk of fraud becomes significantly high and banks need to realize the importance of investing in preventive mechanisms.

We at i-bfp, have been assisting the banking sector by providing fraud preventing mechanisms through our rigorous verification and due diligence services. We have alerted banks about the fraudulent documentations, non-existing collaterals, inflated income figures in the ITR, non-existent income sources, criminal antecedents, cheque bounce histories, mismatching financial statements, inflated rental income etc and assisted the banks in preventing the bad debts.

We have necessary expertise and infrastructure to offer due diligence services at the pre-loan disbursement stage. We have in-house Chartered Accountants, Legal Professionals, Information Technology Professionals, Economists and a well-trained team of employees working exclusively for the banking sector. We are willing to join our hands with your esteemed organization to minimize the risk of defaults and fraud.

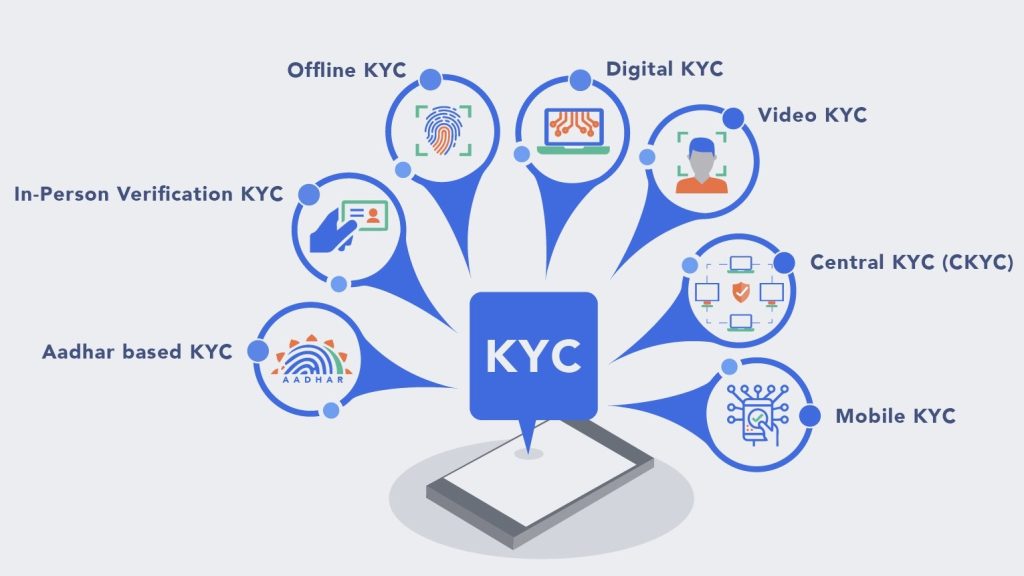

Below are the KYC services we offer in Bangalore currently:

- KYC Field Verification :

- KYC Document Re-Verification :

- Employment Verification :

- Business Verification :

- Criminal Antecedents Verification :

- Property Verification :

- Business Documents Verification :

- Education Loans Verification :

To physically visit and confirm if the applicant has provided the right details.

1) Residential Address Verification

2) Business Place Verification

3) Family Background Check

To confirm if documents provided by the applicants is genuine.

1) Passport

2) Voter ID

3) PAN Card

4) Ration Card

5) Aadhar Number

6) Driving License

To confirm if the employment details provided by the applicant is genuine.

1) Employment Place verification

2) Confirmation of employment status. Whether a permanent employee / probationer etc.

3) Confirmation of tenure of service.

4) Salary Slip / Salary Certificate Verification

To confirm the applicant Business is genuine

Income Proof Verification :

To confirm if the Salary/Business income details are genuine

1) ITR Verification

2) Bank Statement Verification

3) Salary Statement tally with Bank Statement.

4) Balance sheet / Income Statement Cross-Verification with ITR/ROC documents

5) Rental Income Tally as per Bank Statement.

Is there any criminal charges / Civil litigations pending or charged against the applicant, Fraud related cases, cheque bounce cases.

To confirm property address is genuine and is existing.

1) Property Address Verification

2) Property Documents Authenticity Verification – EC Check , BBMP Tax Paid Receipt Check etc

3) Property Litigation Check

4) Proforma Invoice Verification for Purchase of Vehicles and Machineries

To confirm if the Business documents provided by the applicant is Genuine.

1) TIN Number verification

2) Service Tax Number Verification

3) Udyog Aadhar Number Verification

4) Company Details Check with Ministry of Corporate Affairs

To confirm if the details provided by the applicant is Genuine.

1) Verification of Admission Details with the College / University

2) student’s admission receipts.

3) fee statement